Most of us were taught to earn and spend money, but not how to grow or invest it.

I want you to know: that’s not your fault.

I also want you to know: now it’s your turn to learn.

Today, in partnership with FinanceBuzz, I’m sharing six tips to transform your relationship with money, no matter your age or income.

1. It’s about decisions, not income.

When you realize that the decisions you make in your everyday life affect your financial situation, you can better budget, save, and bounce back from financial stress.

Action to Take: list three decisions you can make today. Some ideas include: cancelling a subscription, making coffee at home, or downloading a free budgeting app.

2. You can’t save what you don’t see.

Your brain spends what it labels as “available”, which is why saving is a great first step to having more control over your finances.

Action to Take: If you can, open a separate bank account, automate a realistic percentage of your income to your savings, and call it something fun like a “Freedom Fund”.

3. Buying more won’t build wealth.

Impulse purchases will give you short-term pleasure, but learning about money will give you long-term gain.

Action to Take: spend ten minutes a day reading about a concept that will help you learn more about finances. Over time, all of that information will compound into a wealth of knowledge.

4. You’re not lazy. You’re overwhelmed.

Too many small financial decisions will drain you.

Action to Take: focus on just one financial goal for the next 30 days. Over time, your progress with one goal will build up your confidence to tackle other financial goals.

5. Your money beliefs are probably inherited.

The messages we hear growing up shape our habits, and it’s likely you inherited your beliefs around money from the people you grew up with. The good news is you can rewrite your beliefs.

Action to Take: write down three money beliefs from your upbringing. Ask yourself: ”Do these still serve me?” (Learn more in “Today’s Wiser Choice” below!)

6. Generosity multiplies wealth.

Giving doesn’t deplete your resources. It expands them. When you’re intentionally generous, your mindset, motivation, and long-term financial health all improve.

Action to Take: give something small this week… $5, your time, a skill, a referral. Watch how it shifts your energy toward money.

Remember: money isn’t just about numbers. It’s also about emotion, energy, and identity.

So, start with one shift today.

Your future self will thank you.

How often do you intentionally learn about finances?

Create Breathing Room With Money

Money stress has a way of lingering—showing up in quiet moments, tough decisions, and conversations we put off. Some tools are designed to help ease that pressure so you can focus on moving forward, not treading water.

FinanceBuzz has curated a lineup of 0% intro APR credit card offers that let you pause interest for up to 21 months while you focus on paying balances down. Each is designed to support clarity, flexibility, and steadier progress without adding more weight to what you’re already carrying.

Paid partnership

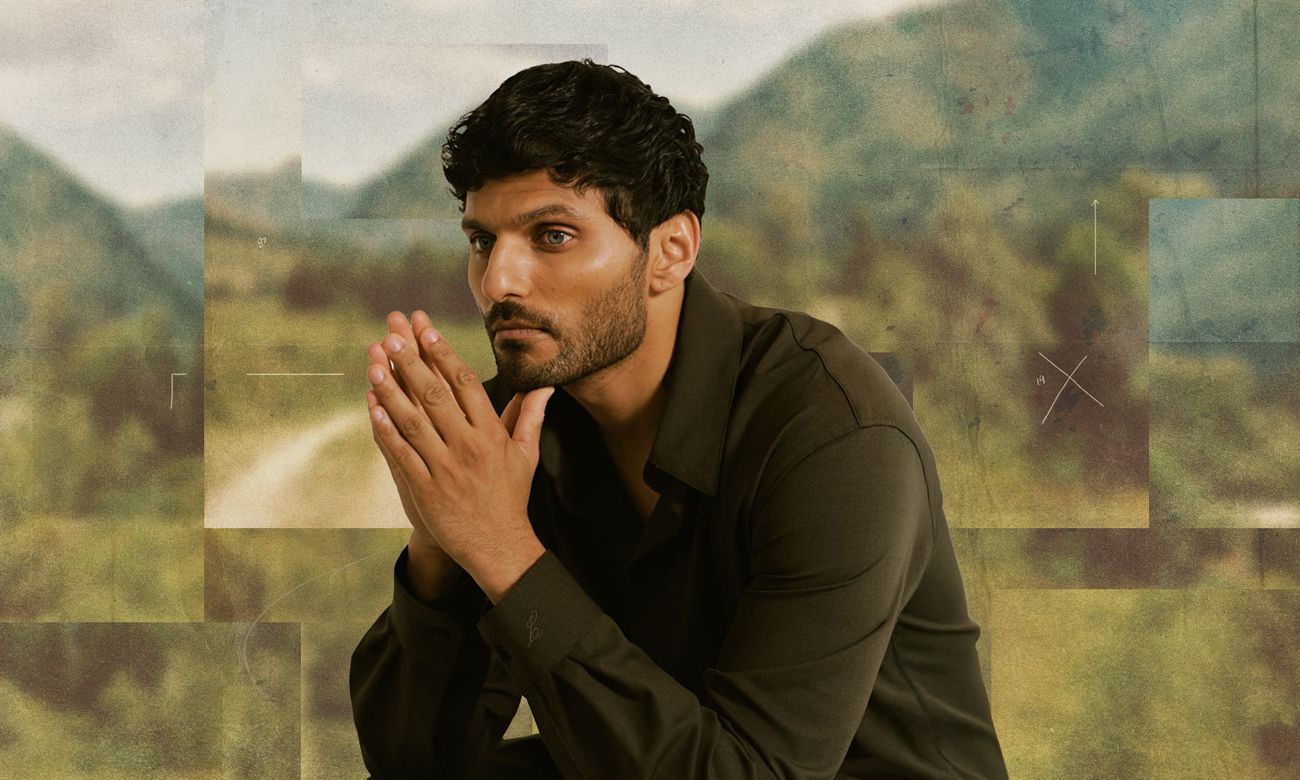

On Purpose

Last Friday on On Purpose, I challenged the way people have been taught to manifest love. Rather than focusing on affirmations, visualization, or waiting for the perfect person to arrive, I reframed manifesting as an internal process of alignment. I explained that love doesn’t appear simply because someone wants it badly enough, it shows up when beliefs, emotional availability, habits, and identity are aligned with sustaining a healthy relationship.

This episode is for you if you want to learn how to choose consistency alongside chemistry, clarity over confusion, and emotional availability over emotional pursuit without lowering standards or losing self-respect.

Listen on: Amazon Music, Spotify, Apple Podcasts, and YouTube.

Today’s Wiser Choice

Try This: Let’s dive more into tip #5, “Your money beliefs are probably inherited.”

Write down three money beliefs from your upbringing. Then ask yourself: ”Do these still serve me?

Next, I want you to rewrite one of your beliefs.

Here are some examples:

“Money is selfish” → “Money is fuel for generosity.”

“I’ll never have enough” → “I can create and attract resources.”

“I’m not good with money” → “I am learning to manage money wisely.”

Once you’ve rewritten a belief, write it somewhere visible: on a sticky note, in your journal, or as a daily affirmation. Each time you see it or say it, notice how it shifts your mindset and opens new possibilities for abundance.